Estate Planning and SMSFs

One of the main reasons an individual would use an SMSF is for estate planning as it can offer greater flexibility to beneficiaries than what is available via a public offer fund. Where a member dies without a binding nomination, the distribution of the death benefits is at the discretion of the remaining trustees. This can result in some planning after the death of a member in order to achieve the optimal tax outcome. For example, one child may be still a minor and be entitled to receive the death benefits tax free. In this situation, the trustee could allocate a greater amount to that child and rely on an estate equalisation clause in the Will to ensure that the other children receive a greater share of the estate assets.

However, there are a number of traps when using an SMSF for estate planning, particularly where there are blended families. It is possible that the individual controlling the trust does not agree with the wishes of the deceased. As they have control of the fund, they can frustrate the attempts of other beneficiaries, such as children from a previous marriage to receive their inheritance, even where the trustee has agreed there is a valid binding nomination in their favour.

Nominations

SMSF members have more options when making a nomination than what is available via a public offer fund. As well as having access to non-binding, binding, non-lapsing binding and reversionary nominations, members also have the option of establishing an SMSF Will.

An SMSF Will is a collection of rules written into the governing rules of the fund’s trust deed which broadly have a similar format to a Will. These rules place an obligation on the trustee and they can be as complex as the member wishes specifying who is to benefit, any contingent beneficiaries and in what form.

It may also be possible to provide for a ‘life interest’ death benefit pension whereby one beneficiary, such as a spouse has an entitlement to the pension payments during their lifetime, but on their death, the capital would be distributed to the beneficiaries of the first deceased, such as any children from a previous marriage.

Superannuation dependants

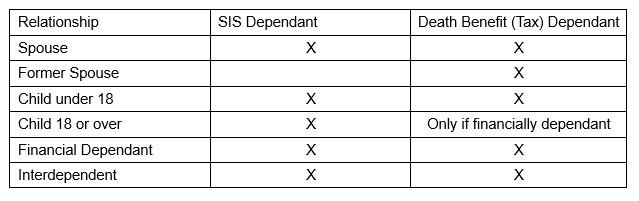

There are three types of dependants for the purposes of death benefits being paid from a superannuation fund. They are:

-

SIS dependants, who can be paid directly from a superannuation fund

-

dependants who are entitled to take their benefit as an income stream

-

death benefit dependants who can receive lump sum death benefits tax-free.

If a member wants some or all of their superannuation benefits to be paid to someone other than those in the above list, they would need to have that portion paid to their legal personal representative and make a provision for that person within their Will.

All beneficiaries who are entitled to receive death benefits directly from a superannuation trustee are allowed, under superannuation legislation, to take that benefit as a lump sum. However, there are restrictions on who can receive death benefits as an income stream. While most of the dependants listed in this table can receive superannuation death benefits as an income stream, children of the deceased who are aged over 18 can only receive an income stream if they are financially dependent and under 25 or they are disabled. Where a child of the deceased receives death benefits as an income stream, the income stream must be commuted and the benefits withdrawn as a tax-free lump sum no later than their twenty-fifth birthday unless they are disabled.

As with many aspects of superannuation, the legislation specifies what is allowable, however individual funds may have more onerous rules in place documented in their trust deed.

Taxation of benefits paid to non-dependants

Where the beneficiary is not a death benefit dependant, any benefits must be taken as a lump sum and the taxable component of the benefit will be subject to tax of up to 15% plus Medicare levy on the taxed element and up to 30% plus Medicare levy on the untaxed element. While the definitions of a dependant in the SIS Act and death benefit dependants in the Tax Act are substantially the same, there is a notable difference. Adult children are SIS Act dependants and therefore, can be paid directly by the trustees of the superannuation fund, however as they are not death benefits dependants as defined in the Tax Act, the benefits will be subject to tax.

For tax purposes, the relevant beneficiary is the ultimate beneficiary. Therefore, a benefit that passes through the estate but is paid to a death benefit dependant beneficiary will be tax-free. There can be an issue where the benefits are paid to the beneficiaries via a testamentary trust. While it may be envisaged that the only persons to benefit from the fund are death benefits dependants, the trust may have potential beneficiaries that aren’t death benefit dependants in which case all benefits appropriated to the trust will be subject to tax. A possible solution is to provide in the will a superannuation benefits testamentary trust that limits beneficiaries and potential beneficiaries only to death benefit dependants.

Source: BT